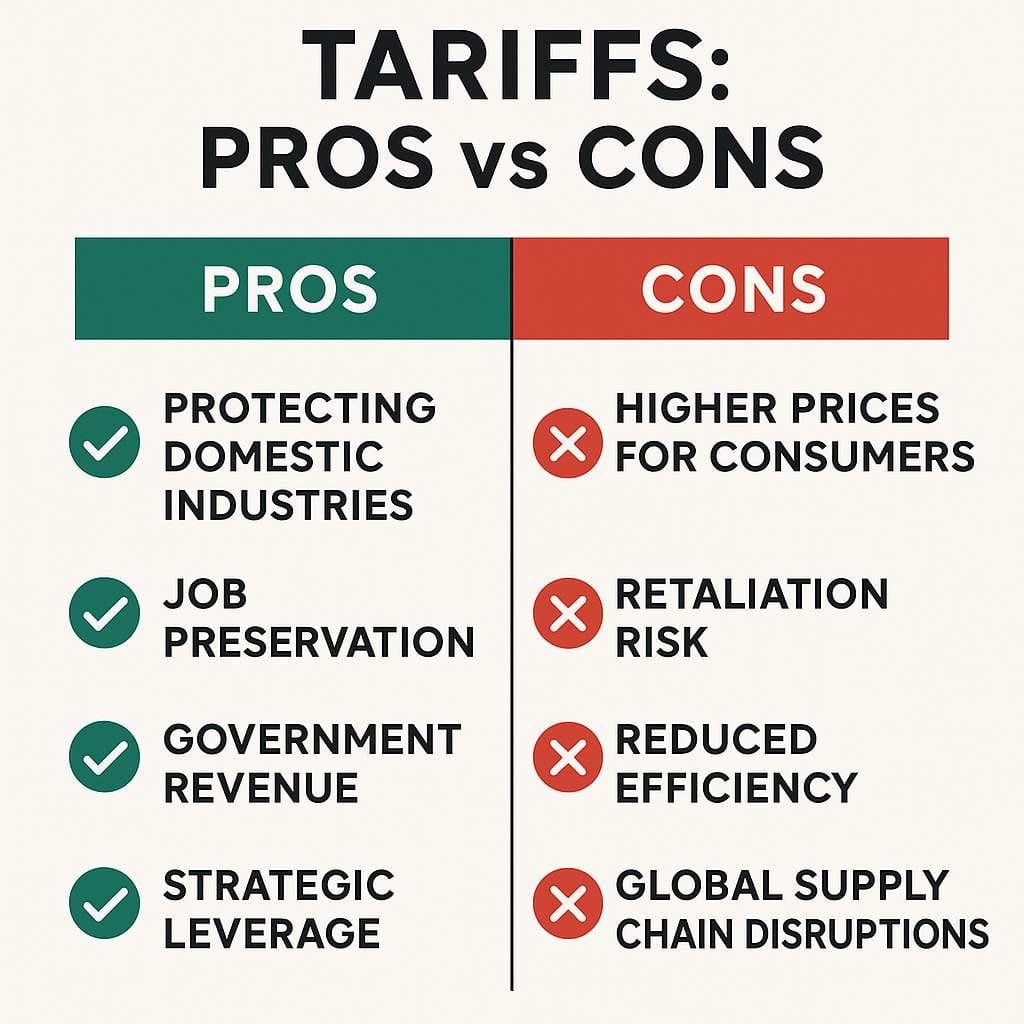

Tariffs—taxes on imported goods—have long served as tools for governments to shape trade policy, protect domestic industries, and generate revenue. But like any economic lever, they come with both advantages and drawbacks.

Pros of Tariffs:

- Protecting Domestic Industries: Tariffs can shield emerging or struggling local industries from foreign competition, giving them room to grow and innovate.

- Job Preservation: By making imported goods more expensive, tariffs can help maintain jobs in domestic sectors that might otherwise lose out to cheaper overseas labor.

- Government Revenue: Especially for countries without broad-based tax systems, tariffs provide a straightforward way to collect funds.

- Strategic Leverage: Tariffs can serve as bargaining chips in trade negotiations, encouraging other countries to lower their own barriers.

Cons of Tariffs:

- Higher Prices for Consumers: Tariffs immediately hit consumers’ wallets by raising the prices of imported goods.

- Retaliation Risk: Other countries may respond with their own tariffs, sparking trade wars that hurt multiple economies.

- Reduced Efficiency: Tariffs can distort market signals, propping up industries that may not be globally competitive.

- Global Supply Chain Disruptions: In a world of interconnected production, tariffs can complicate sourcing and increase costs for businesses.

Bottom line: Tariffs are neither inherently good nor bad—they’re tools. When used strategically and sparingly, they can bolster domestic priorities. However, if overused or misused, they risk backlash, inefficiency, and economic drag. Therefore, in a globalized economy, maintaining balance is essential.